The Architecture of a Liquid Market: How ETHGas Engineers a New Asset Class from Ethereum Blockspace

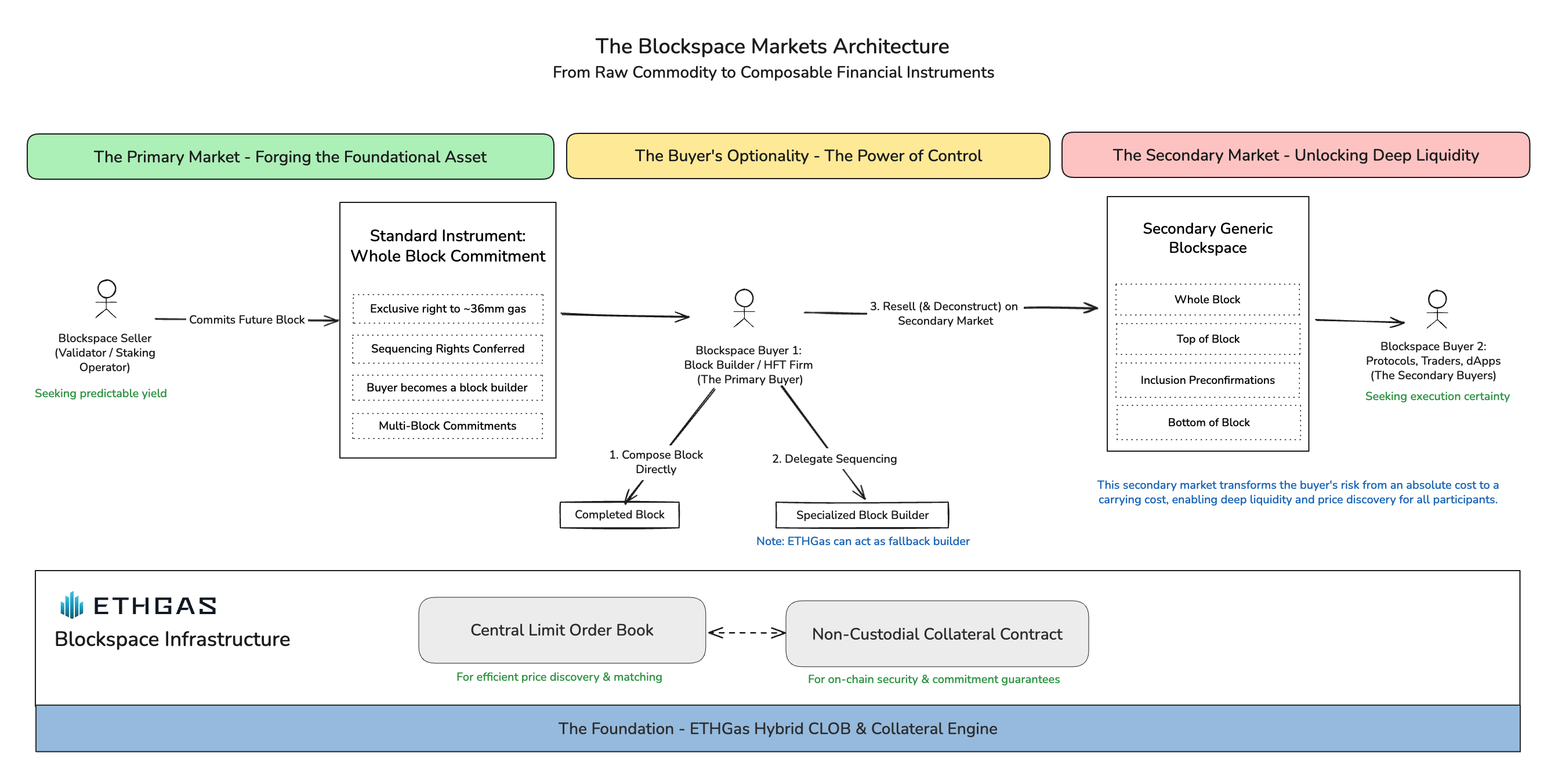

A technical deep-dive into the hybrid exchange and standardization engine that transforms Ethereum's most volatile commodity into a suite of composable, tradable financial instruments.

For years, the industry has viewed gas as a 'transaction fee'—a volatile, unpredictable cost of doing business on Ethereum. This is a limited view. At ETHGas, we see gas not only as a fee, but also as the economic fabric of the blockchain itself and a malleable instrument to be shaped, traded and financialized.

For a foundational guide on blockspace as a commodity, read our primer, Ethereum Blockspace Explained.

While the current Proposer-Builder Separation (PBS) market ‘works’, it remains primitive. We believe it can be elevated into a more multifaceted, rich, and transparent marketplace accessible to a far larger number of users. When we approached this system, we sought not to build something incremental, but to re-architect it from first principles. Our goal was to find the Pareto-efficient design that could achieve a global maximum for the ecosystem, unlocking a new infrastructure industry that will spur the next wave of innovation at the application layer.

Market Design: A Hybrid CLOB for a New Commodity

To financialize blockspace, you first need a proper venue. While the industry initially struggled with how to execute let alone price a preconfirmation, we have taken the concept lightyears into the future. We achieved this by employing a sophisticated structure, system design, and radical standardization, all accessible through an interface built to price and exchange these new instruments. This is accelerationism in action.

To achieve this, we built an out-of-protocol hybrid exchange that combines the low-latency matching of a centralized limit orderbook (CLOB) with the security of non-custodial smart contracts for validator collateral. This design provides the speed and privacy required for sophisticated actors while ensuring all commitments are backed by verifiable, on-chain collateral.

The Core Principle – Standardization Before Liquidity

Our entire market is built on a foundational principle from mature financial markets: standardization is the prerequisite for liquidity. By standardizing the infinite permutations of raw blockspace into a few definite product types, we unlock the power of a secondary market. This is a critical leap. It transforms the economic exposure for a buyer from an absolute cost (the full purchase price of the asset) to a carrying cost (the net cost after reselling parts of the asset), enabling true price discovery.

Engineering the Primitives: From Raw Commodity to Tradable Instruments

Here’s the engine that puts the principle into action:

1) The Standard Instrument: The Whole Block Commitment

The foundational instrument is the Whole Block Commitment. A validator sells the rights to an entire future block's payload (currently ~36mm gas) to a single buyer. This buyer is now a block owner and could be called a commodity trader, a market maker, or even potentially a block builder, holding the exclusive right to sequence that block. This is the macro-level asset for Ethereum blockspace.

2) The Pivotal Mechanism: Deconstruction & ResaleThe holder of a Whole Block Commitment can now "strip apart" their asset and sell portions of it on our secondary market. This is the pivotal mechanism.

- Top of Block: This typically carries the most value in a block as it entitles the party to place trades before everyone else in the block. In this instance, the whole block buyer can retain the top-of-block rights for a high-value strategy and then auction off the rest of the block to a competitive range of block builders

- Generic Blockspace: The Inclusion Preconfirmation

When a Whole Block is deconstructed, a new, standardized instrument is created: the Inclusion Preconfirmation. It represents a collateral-backed commitment for a fixed amount of gas to be included within a specific future block. It is the fungible, generic unit of transaction delivery, allowing market participants to buy the precise amount they need, for a specific future slot, without needing to purchase an entire block.

3) Compound Instruments: Multi-Block Commitments

The value of sequential blocks is superlinear - Taking the Whole Block to the next level, our architecture allows for the combination of multiple block commitments. This enables sophisticated actors to execute complex, multi-transaction strategies that require guaranteed sequencing across several blocks offering unparalleled opportunities vs those available today.

This architecture as a whole is Financially Composable, and can be seen as analogous to options markets. In these markets, a trader can trade the singular option (the Whole Block Commitment) or its constituent "Greeks" (Top of Block, Inclusion Preconfirmations, Bottom of Block, and so forth). This is how you build the Blockspace Markets.

The Blockspace Markets Architecture

The Economic Impact: Quantifying the Edge

This architecture creates specific, quantifiable advantages for key market actors.

- For Validators & Staking Operators: Stop relying on unpredictable MEV. By selling Whole Block Commitments, you create a bookable, more predictable revenue stream. Based on our internal modeling, this represents a potential 10-15% lift in execution layer rewards or about 3-5bps today. As network effects take hold, one would expect this to rise meaningfully.

- For Traders: Precision execution - the whole block markets enable traders to not only deploy more GPUs and run more sophisticated searching algorithms thus capturing higher yields, but also aggregate multiple blocks together for a richer, more meaningful experience.

- An Inclusion Preconfirmation is a non-cancellable, collateral-backed guarantee of execution. For a $1M DEX swap, that's the difference between alpha and a costly failure. It turns execution risk into a fixed cost.

- For Protocols: Imagine ensuring against harmful MEV attacks, one could ensure that oracles driving updates to a lending protocol could update at the top of the block enabling rebalancing and repricing to occur before liquidations. Alternatively, one could sequence trades in an entirely different order for the betterment of your users.

- For Market Makers: We abstracts away the operational complexities of PBS. You now have distinct, composable products to trade, arbitrage, and provide liquidity against. This is a new frontier for sophisticated players.

Conclusion

We have built the financial market for Ethereum's core commodity.

By engineering standardized, composable products and providing a high-performance venue to trade them, we have created the necessary infrastructure for a Realtime Ethereum. The architecture is complete. The market is live at https://app.ethgas.com/markets.

.png)